Tax Invoice is the essential document to be issued by a registrant when a taxable supply of goods or services is made. Under VAT in UAE, a Tax Invoice is to be issued by all registrants for taxable supplies to other registrants, where the consideration for the supplies exceeds AED 10,000. Hence, 2 conditions to be met for issuing a Tax Invoice are:

- The recipient should be registered and

- The consideration for the supplies should exceed AED 10,000

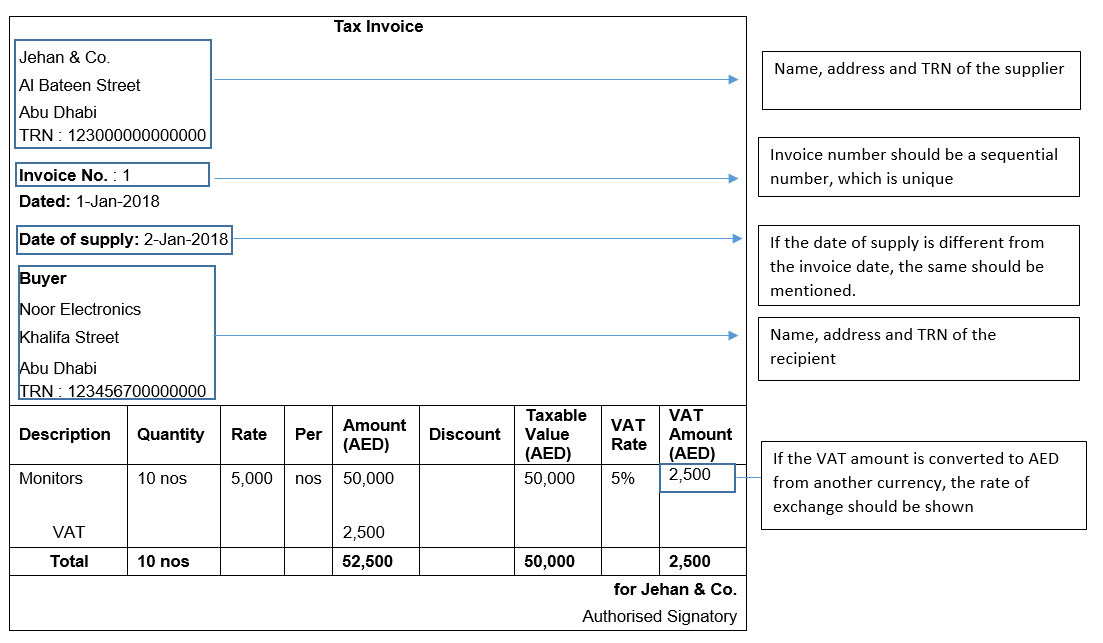

Tax Invoice Format

As per the mandatory details required in a Tax Invoice, a sample format of a Tax Invoice is shown below:

Note: When the Tax Invoice relates to a supply for which the recipient should pay tax, a statement that the recipient is required to account for tax, under Article 48 of the VAT Law should be given in the Tax Invoice.

Most businesses in UAE, except retail businesses, would be dealing with supplies for which Tax Invoice is to be issued. As the mandatory details required in any Tax Invoice issued by registrants has been laid down in the VAT law, it is essential that all invoices issued under the VAT regime meet these requirements. If Tax Invoices issued do not contain the required information, it could lead to an Administrative Penalty. In this regard, it would be useful for all businesses to use a software which would automatically pick the details required in a Tax Invoice, notify the user if any mandatory details are not given in the Tax Invoice, generate the Tax Invoice quickly and most importantly, keep updated about all the details that are required to be given in a Tax Invoice. Ensuring that Tax Invoices are issued correctly by suppliers is also important for the recipient of the supply. The Tax Invoice serves as the basis on which the recipient can claim input tax deduction on the supply. Hence, businesses should take measures to ensure that Tax Invoices issued under VAT are accurate and complete.

Read more about UAE VAT

UAE VAT Return, VAT in UAE, How Does VAT System Works, Frequently Used Terms in VAT, VAT Exempt Supplies in UAE, VAT Return Form 201, Tax Audit under VAT in UAE, Supply under UAE VAT, Supply of Goods and Services in UAE VAT, Input Tax Recovery under VAT in UAE, VAT Return Filing in UAE, VAT Return Filing Period in UAE, Tax Agent under UAE VAT, Checklist for Tax Return Filing under VAT in UAE, Bill–to-Ship-to Supplies in UAE VAT, Single Composite Supply in UAE VAT, VAT Applicability on Different Types of Supplies in UAE

VAT Rate

VAT Rate in UAE, VAT Rates Applicable to Education Sector in UAE, Difference between Zero Rate, Exempt and Out of Scope Supplies in UAE VAT, UAE VAT Rates- Handbook, Standard Rated Purchases/Expenses in VAT Form 201, Zero-Rated and Exempt Supplies in VAT Form 201, Zero-Rated Supplies in UAE VAT, Use of Exchange Rates in VAT Invoice, Freelancer’s Guide to VAT, How to handle Multiple Supplies in UAE VAT